Similar to calculating net credit sales, the average accounts receivable balance should only cover a very specific time period. For example, retail companies generally have higher asset turnover ratios because they sell products quickly and need fewer assets to generate sales. In contrast, industries like real estate, manufacturing and utilities often have lower asset turnover ratios.

How to Calculate Accounts Receivable Turnover Ratio

The next step is to calculate the average accounts receivable, which is $22,500. The net credit sales come out to $100,000 and $108,000 in Year 1 and Year 2, respectively. The average accounts receivable is equal to the beginning and end of period A/R divided by two. When making comparisons, it’s ideal to look at businesses that have similar business models.

Examples of Accounts Receivable Turnover Ratio

Now that we have understood its importance, here are a few tips for businesses to tap in order to increase the receivable turnover ratio. Businesses should strive for a ratio of at least 1.0 to ensure that it collects the whole amount of typical accounts receivable at least once per quarter. A low turnover ratio could also mean you are giving credit too easily, or your customer base is financially unreliable. In that case, you might reconsider your credit policies to possibly increase sales as well as improve customer satisfaction. As such, the beginning and ending values selected when calculating the average accounts receivable should be carefully chosen to accurately reflect the company’s performance. Investors could take an average of accounts receivable from each month during a 12-month period to help smooth out any seasonal gaps.

Accounts Receivable Turnover Ratio: What is it and How to Calculate it

- Your banker will want to see this track to determine the bank’s risk since accounts receivables are often used as collateral.

- A low turnover ratio may also be caused by the entity’s own inabilities, like following an inappropriate credit policy or having defects in its collection process etc.

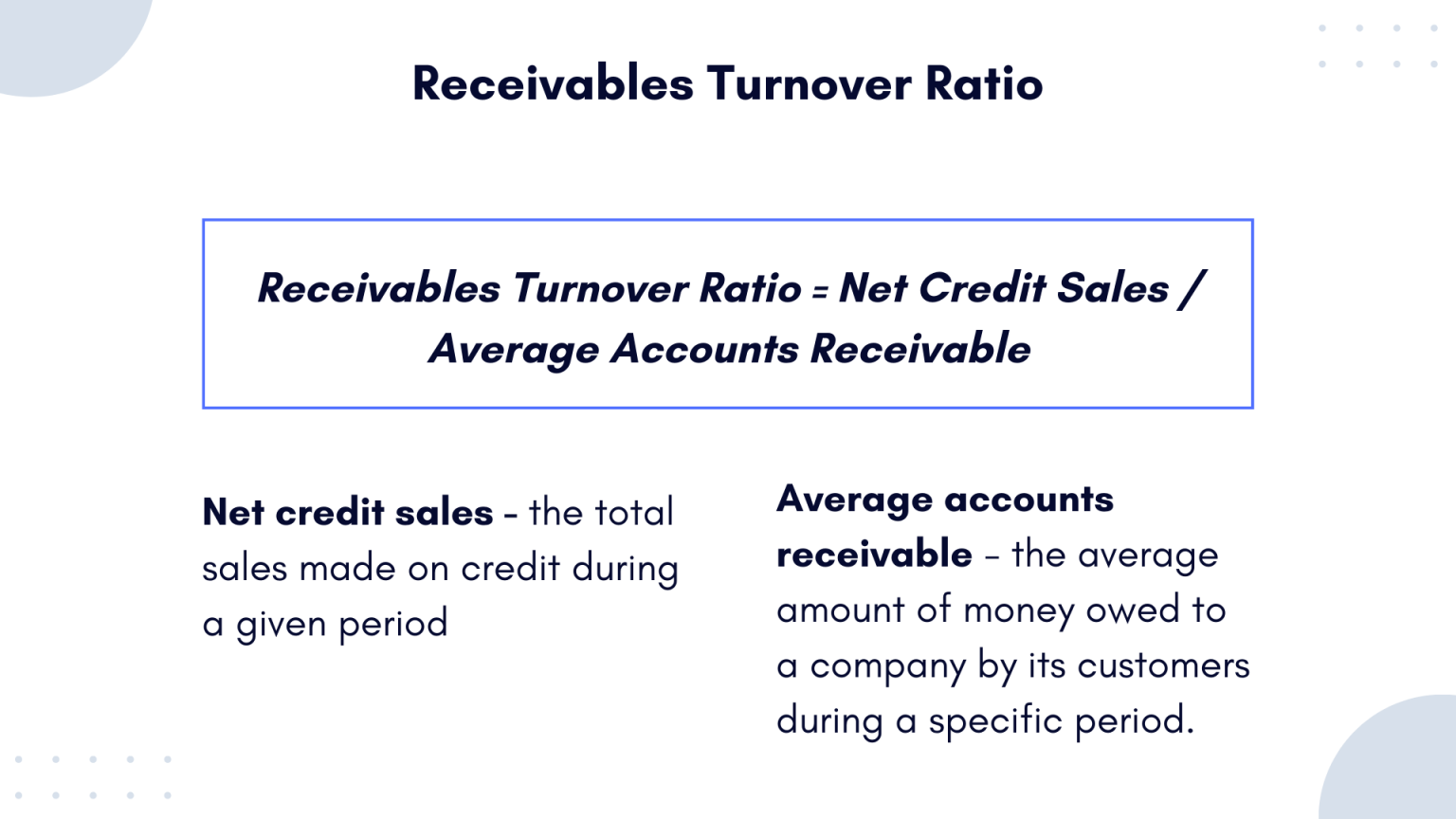

- To calculate net credit sales, simply deduct sales returns and allowances from total credit sales.

- Since it also helps companies assess their credit policy and process for collecting debts, this metric is often used by financial analysts or investors to measure the liquidity of a certain business.

Efficiency ratios can help business owners reduce the amount of time it takes their business to generate revenue. The accounts receivable turnover ratio (A/R turnover) is a measure of how quickly a company collects its accounts receivable. It is calculated by dividing the annual net sales revenue by the average account receivables. Higher turnover ratios imply healthy credit policies, strong collection processes, and relatively prompt customer payments.

Once you have calculated your company’s accounts receivable turnover ratio, it’s nearly time to use it to improve your business. But first, you need to understand what the number you calculated tells you. If you have a high accounts receivable turnover ratio, this could mean you have managed your cash flow well, and have maintained stronger creditworthiness. The two components of the formula of receivables turnover ratio are “net credit sales” and “average trade receivables”. However, in examination problems, the examiners often don’t provide a separate breakdown of cash and credit sales.

How to Pay Yourself From an LLC [2024 Guide]

These red flags can hint at underlying operational issues or demand constraints, necessitating further investigation into sales and collection processes. Analyzing balance sheets is a fundamental aspect of financial statement analysis, offering insights into a company’s financial position at a specific point in time. The balance sheet presents a snapshot of assets, liabilities, and equity, allowing investors and analysts to assess liquidity, solvency, and financial stability. By evaluating metrics such as current and quick ratios, debt-to-equity, and asset turnover, one can gauge operational efficiency and potential financial risks. Understanding balance sheet dynamics is essential for making informed investment decisions and assessing a company’s long-term financial health.

It’s indicative of how tight your AR practices are, what needs work, and where lies room for improvement. Average accounts receivables is calculated as the sum of the starting and ending receivables over a set period of time (usually a month, quarter, or year). That number is then divided by 2 to determine an accurate financial ratio. However, a turnover ratio that’s too high can mean your credit policies are too strict.

As we previously noted, average accounts receivable is equal to the first plus the last month (or quarter) of the time period you’re focused on, divided by 2. Liberal credit policies may initially be attractive because they seem like they’ll help establish goodwill and attract new customers. Although that may be true, nothing negates positive feelings like having to hassle someone over unpaid bills.

On the other hand, having too conservative a credit policy may drive away potential customers. These customers may then do business with competitors who can offer and extend them the credit they need. If a company loses clients or suffers slow growth, it may be better off loosening its credit policy to improve sales, even though it might lead to a lower accounts receivable turnover ratio. Asset turnover ratio helps assess how efficiently a company uses its assets to generate revenue. If Company C has annual revenue of $3 million and average total assets of 1 dollar million, its asset turnover ratio would be 3.0, meaning it generates 3 dollars for every 1 dollar of assets. This efficiency might reflect effective management and high demand for the company’s products.

A company with a higher ratio shows that credit sales are more likely to be collected than a company with a lower ratio. Since accounts receivable are often posted as collateral for loans, quality of receivables is important. Furthermore, a low accounts receivable turnover the 7 most common types of errors in programming and how to avoid them rate could indicate additional problems in your business—ones that are not due to credit or collections processes. When companies fail to satisfy customers through shipping errors or products that malfunction and need to be replaced, your company’s turnover may slow.

Manufacturing usually has the lowest AR turnover ratios because of the necessary long payment terms in the contracts. The projects are large, take more time, and thus are invoiced over a longer accounting period. Additionally, some businesses have a higher cash ratio than others, like comparing a grocery store to a dentist’s office. Therefore, the accounts receivable turnover ratio is not always a good indicator of how well a store is managed.