Sales receipts typically include things like the customer’s name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable). You can now see each customer’s retainer or deposit balance, as well as a record of transactions that have affected this balance. If you created a separate trust liability bank account to hold retainers or deposits, once you have turned the retainer into income, you can transfer that money to your operating bank account.

How confident are you in your long term financial plan?

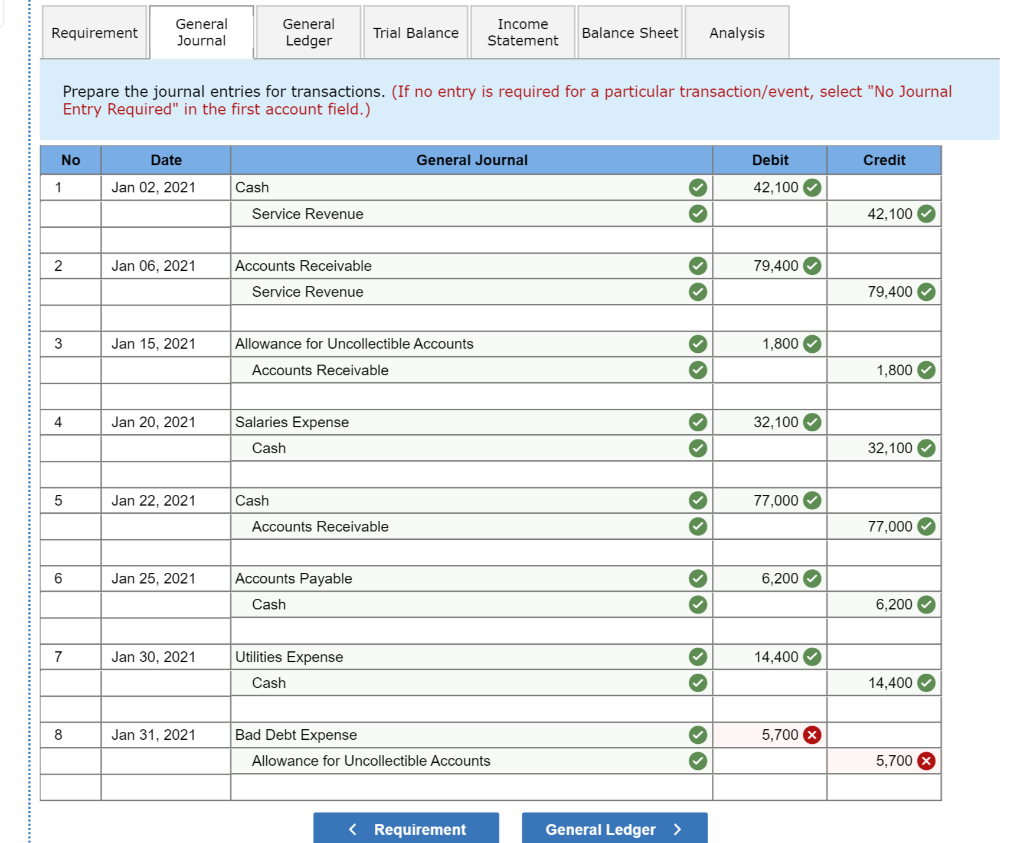

When a customer pays an invoice, an account receivable collection journal entry is required to clear the amount on their account. A common error made when posting entries from a cash receipts journal is to forget to post the individual amounts in the accounts receivable column to the subsidiary ledger accounts receivable. This can cause the customer’s account to be inaccurate and may result in the customer being overcharged or undercharged. In some cases, you might receive a check or cash payment from a customer later on. In these cases, you will need to make a separate cash received journal entry to record this information. You must also track how these payments impact customer invoices and store credit.

Stay up to date on the latest accounting tips and training

If you keep the money in your operating account, this procedure is unnecessary. When in doubt, try to reflect your real-world situation as much as possible. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our invoice requirements eu vat writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

How to Manage and Record Cash Receipts in Your Small Business

Journal Entry for Cash Payment of ExpensesWhen cash is paid for certain expenses such as rent, then an entry must be booked to record the expense, and also record the cash that has been paid. Cash and expenses both have a normal debit balance, therefore the following entry will increased expense with a debit and decrease cash with a credit. Cash receipts are the written proof that your business has made a sale. One copy of the cash receipt goes to the customer as proof of buying the product or service, while another copy stays with the business that has made the sale. When customers pay with a mixture of payment methods, you need to account for it.

- The amount will depend on the agreed price between customer and supplier.

- Cash receipts are the written proof that your business has made a sale.

- In this case one asset (cash) increases representing money received from the customer, this increase is balanced by the increase in liabilities (cash advances account).

- Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit).

Devise procedures for managing overdue accounts

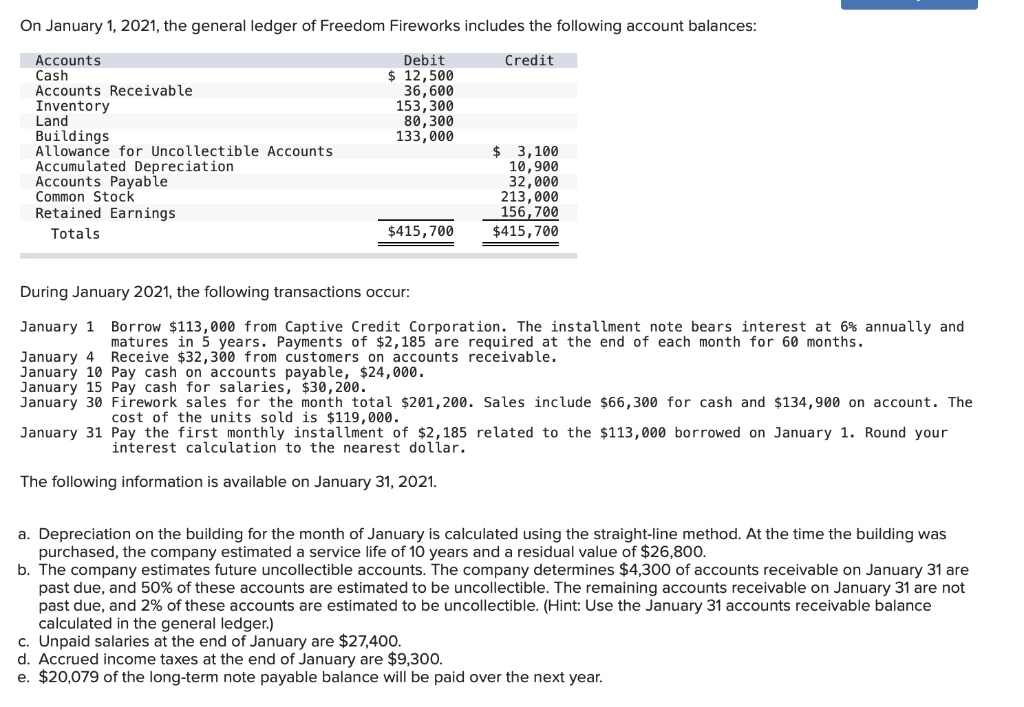

Accounts receivable is essentially a running total of the amount owed to the business by the companies or persons receiving the goods or services. If your business collects cash from customers, you need to account for it properly. This process can become complicated if you have individual invoices or bookkeeping entries for a good or service sold to each customer, and if you then make lump-sum deposits of cash to your bank.

Establish methods of payment and credit terms

Even now she is senior, “people won’t assume I am head chef – they always go to the male colleague who is near me”. “Even today, when it comes to family-work life balance, women do have more responsibilities and it is hard for them to choose between their career and family,” she says. “I would need help carrying the crate of onions, or the masala, and the male chefs would be more than happy to help me. But that’s the only difference between me and a male chef.” “I grew up behind the counter, trying to see over and make myself useful while my parents ran the restaurant,” she says. “My brother and I would stack cans under the counter, and we would wait for customers to leave to go and lay the tables.”

Alternatively, providing the cash advance relates to revenue, a deferred or unearned revenue account could have been used. For example, suppose a business receives an order from a customer to manufacture a product and, due to the size of the order, requires 8,000 cash advance from the customer. The product has not been manufactured or delivered and therefore the revenue has not been earned and so must be recorded as a liability. You might decide that outsourcing debt-collection would be suitable for your business. A collection agency will take over the task of collecting from your customers and will pay you a percentage once they collect on your accounts.

In addition, the post reference “cr” is recorded to indicate that these entries came from the cash receipts journal. For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column. The amount of $506 is then placed in both the cash debit column and the sales credit column. A received cash on account journal entry is needed when a business has received cash from a customer and the amount is not allocated to a particular customer invoice or the customer has not yet been invoiced.

The steps are similar to creating a Sales receipt except that you won’t select a Deposit to account until you receive payment against the invoice. Follow this step if you keep the money from customer retainers and deposits in a separate trust account. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.These articles and related content is provided as a general guidance for informational purposes only.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. The news sent the stock plummeting as much as 17%, dragging it to the bottom of the FTSE 100 and erasing more than £439m from the company’s market capitalisation. The accounting error is expected to result in a £105m hit to pre-tax profits in its south division this year, followed by £50m next year and £10m in 2026. The expense reduces your liability account and your chosen bank account without affecting any of your business expense accounts. Expenses and items are now tracked by customer, enabling you to view transactions and their effect on the customer’s retainer.