So a cost center helps a company identify the costs and reduce them as much as possible. And a profit center acts as a sub-division of a business because it controls the most important key factors of every business. A cost centre can be a location, person, an item of equipment for which we determine cost.

Invest in Employee Training – Strategies for Effective Management of Cost Centers

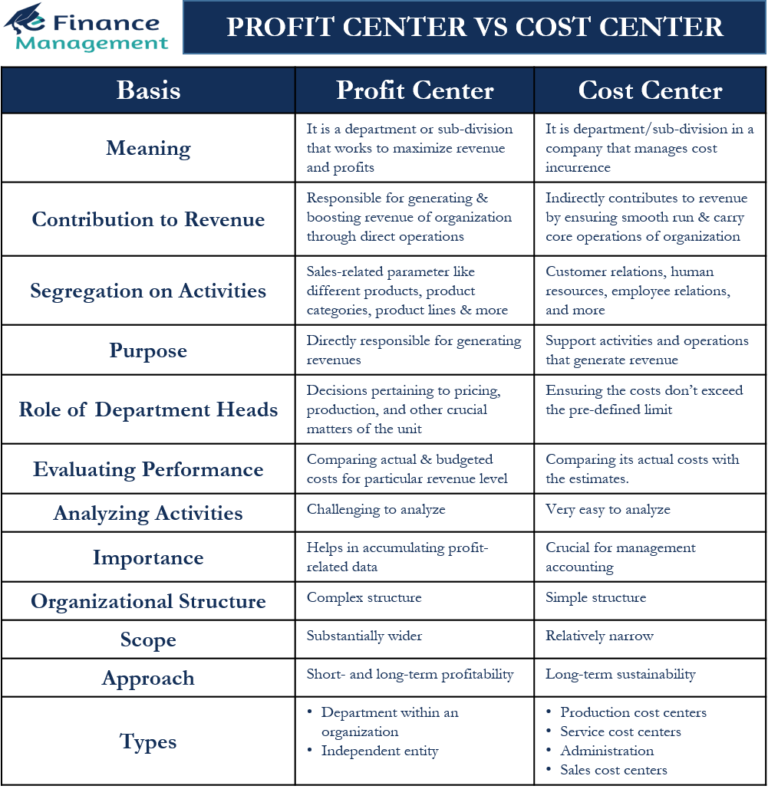

A cost center is a department, division, or unit within an organization that incurs costs but does not directly generate revenue. The primary objective of a cost center is to control and manage expenses efficiently. Cost centers are typically found in large organizations where various departments contribute to the overall operations. Examples of cost centers include administrative departments, IT support, maintenance, and human resources. Meanwhile, profit centers are responsible for generating revenue and driving organizational profits.

What is Profit Center? – The Key Differences Between Cost Centers and Profit Centers

Hence, the subdivision of the factory into a number of departments becomes essential. We divide the organization into various sub-units for the purpose of costing. These sub-units are the smallest area of responsibility or segment of activity. A company may choose to have as many cost centers it feels necessary to best understand how the supporting, non-revenue areas of the company support the revenue-generating areas. Companies must also be mindful that having too many cost centers creates an administrative burden on tracking expenses and may dilute the usefulness of information. A service cost center groups individuals based on their function and may more closely refine the costs within a department.

Cost center vs profit center vs investment center

In this post, you will come to know the fundamental differences between cost centre and profit centre. On a related note, cost centers may also identify where current deficits exist and more resources need to be delivered. Companies can compare cost centers from different regions or teams to better understand the resources successful cost centers have and how they need to better support other areas.

Conclusion – The Key Differences Between Cost Centers and Profit Centers

Additionally, the process of allocating indirect costs can be complex and time-consuming. Running a cost center is a logistical burden that requires a company to perform potentially extra work to track, collect, and analyze information. Invest in employee training to ensure staff members have the necessary skills and knowledge to perform their jobs effectively.

Cost Centers and Profit Centers- Recommended Reading

Unlike the investment centers of the business, the cost centers do not earn money, but they are critical parts of helping the company run and often can not simply be eliminated. Operational cost centers group people, equipment, and activities that engage in a singular commonly-themed activity. Most often, operational cost centers may be seen as common company departments that group employees based events spotlight on their function within the company. The important part to note is an operational cost center is a back-office function that, while it may represent an entire department, does not generate revenue. A cost center may be more appropriate if the primary goal is to control and manage expenses. A profit center may be a better choice if the goal is to generate revenue and increase profitability.

A cost centre is a department or a unit that supervises, allocates, segregates, and eliminates all sorts of costs related to a company. The cost centre’s prime work is to check the cost of an organisation and to limit the unwanted expenditure that the company may acquire. Such an activity centre comprises of location, department or an item of equipment is an impersonal cost centre. This type of activity centre comprises persons or groups thereof in connection to which costs are ascertained.

- To optimize profits, management may decide to allocate more resources to highly profitable areas while reducing allocations to less profitable or loss-inducing units.

- Organizations can gain insights into their overall performance by tracking performance metrics for cost and profit centers.

- They’re responsible for all actions related to production and the sale of goods.

- In the simplest sense, those sections of the organization where costs are incurred and recorded, either by item, by product or by the department, are cost centres.

- In this article, we will explore the differences between cost and profit centers, their roles in a business, and how they contribute to the success of an organization.

However, this division is still not appropriate because the departments are big. Therefore, we can make a comparison of the cost that is accumulated cost centre-wise, with the standards, estimates and budgets. Think of a situation when the whole factory is treated as a single unit for both budgeting and cost control purposes.

The resources allocated to cost centers are intended to support the provision of services and support to other parts of the organization cost-effectively. Cost centers are evaluated based on their ability to manage costs within budget while providing necessary support and services to other departments. Meanwhile, profit centers typically have a higher level of decision-making authority, as their primary objective is to generate revenue and profits for the company. Profit centers have the autonomy and authority to make strategic decisions, set prices, and manage costs to maximize revenue and profitability.

Cost centers are any units or departments within a business that are responsible for incurring costs. For example, a maintenance department would qualify as a cost center because it spends money to maintain facilities and equipment rather than generating profit. At the heart of cost centers is the notion of fiscal responsibility, the idea that different groups of individuals should be responsible for the financial outcome of their area. By separating out groups, even groups that do not make money, department leaders are put in charge about managing their team’s finances.

It operates as a separate business entity within the company and has the goal of maximizing profits. While cost centers focus on cost control, profit centers focus on revenue generation and profitability. In conclusion, cost and profit centers are distinct business units with unique characteristics, advantages, and disadvantages.